Signature Assets

Morningstar Economic Moat Rating

The Morningstar Economic Moat Rating, borrowing the Warren Buffett-coined term, indicates a company’s competitive edge. Companies with a wide moat have advantages expected to last 20 years or more, while those with a narrow moat have strengths likely to last at least 10 years. No-moat companies lack a lasting edge.

The Morningstar Economic Moat Rating may be displayed on its own.

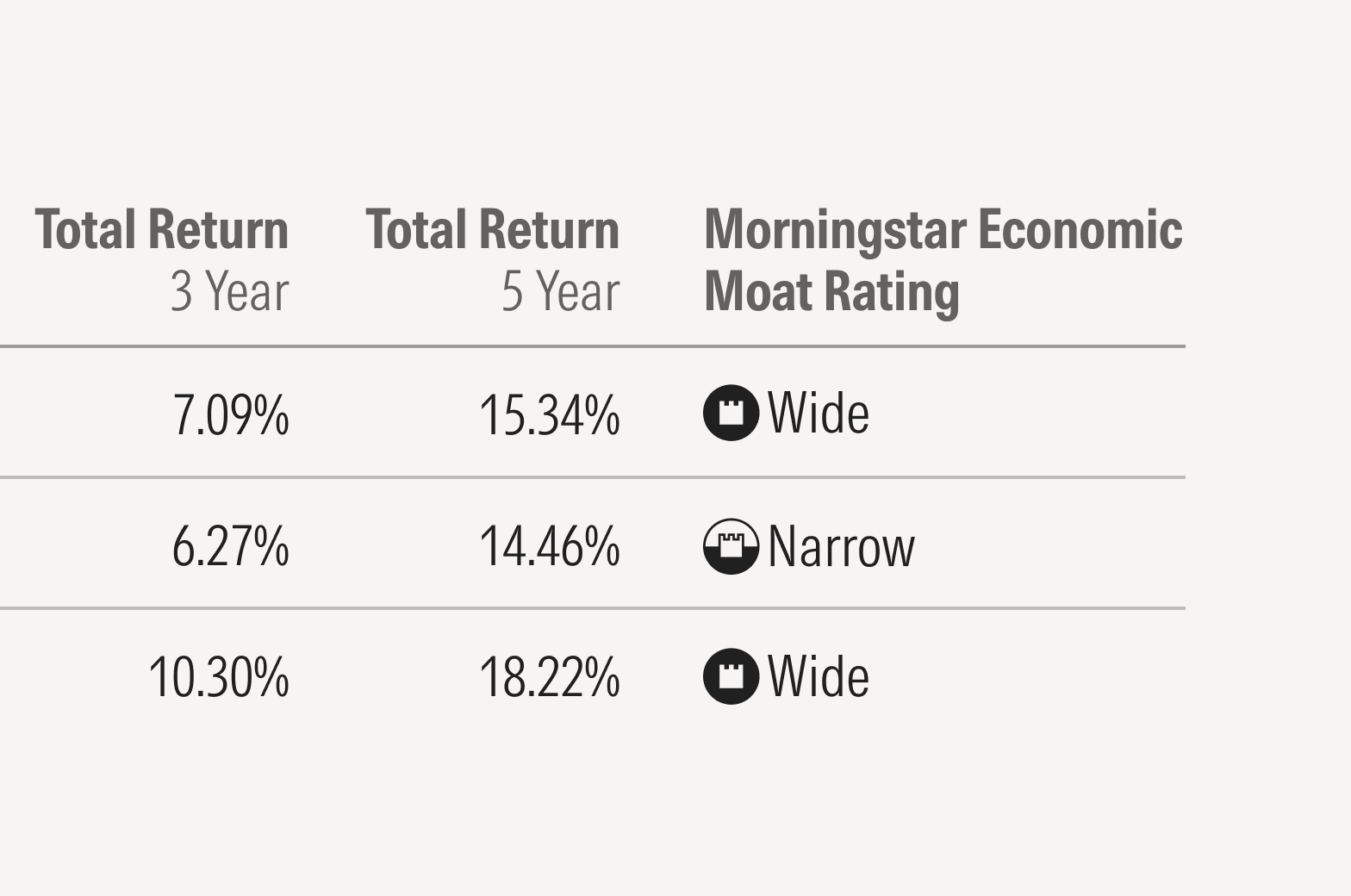

The moat rating may be displayed in tables or other data visualizations.

Don’t use the rating in stock or fund headers.

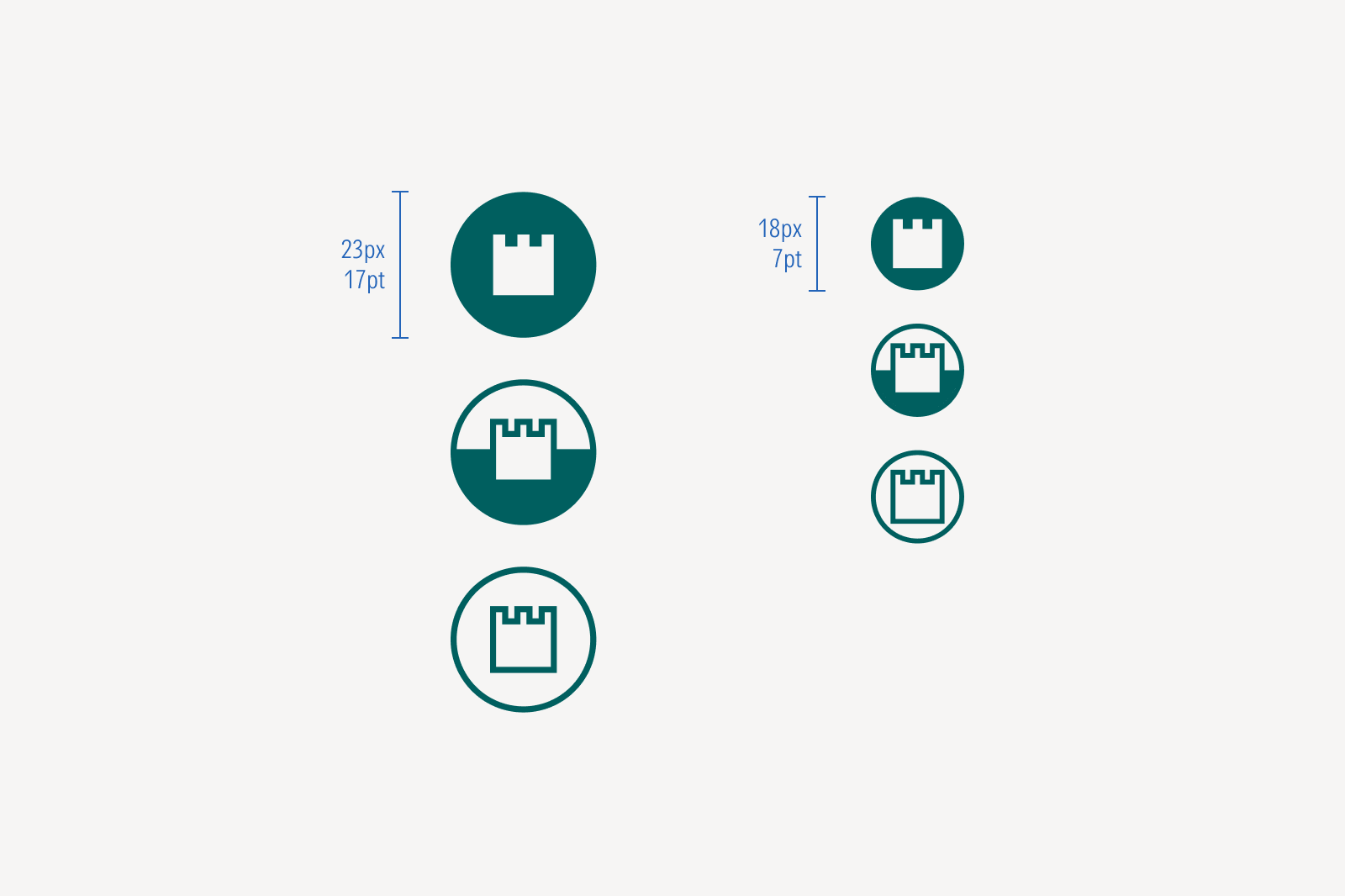

Apply color with the hex value of #005F5F to the large-format artwork.

Apply Neutral 100 (Black) to the small-format artwork.

Recommended minimum clear spacing around the rating artwork when paired with its verbal rating

The verbal rating cap height should match the cap height of surrounding inline text. The minimum inline space is equal to a third of the cap height.

Don’t rearrange the order of the artwork and verbal rating.

Don’t apply gradients, drop shadows, or other decorative treatments to the rating.

Usage in Text

Always write out the official name, the Morningstar Economic Moat Rating, on first reference. The term “moat rating” is acceptable for subsequent references.

Watch hyphenation: “narrow moat rating” (a moat that is narrow) but ”wide-moat company” (a company with a wide moat, not a moat company that is wide).

Do write out “Morningstar Economic Moat Rating” in text.

Don’t use the rating artwork in place of text.